As the looming climate crisis nears what climate scientists call a tipping point for our planet’s future, carbon markets are increasingly gaining traction with mainstream investors.

With a critical role to play in both global net-zero emissions goals and the journey towards a sustainable future, nature-based carbon projects provide an opportunity for responsible investors to grow their portfolios and become part of the solution to the climate crisis.

Understanding how the carbon markets work and why nature-based projects have gained such traction is key to building a greener environmental, social and governance (ESG) investment portfolio.

Carbon markets and carbon credits

Generated by fossil fuels, the burning of organic matter and heavy industry, carbon dioxide accounts for nearly 80 percent of all greenhouse gas emissions. This means that to be effective, any large-scale climate action initiative must address carbon emissions. Fortunately, CO2 can be removed from the atmosphere or sequestered through a multitude of different processes.

These processes form the basis of the carbon market. An individual, business or government agency can effectively ‘cancel out’ their emissions by purchasing or investing in carbon offsetting projects. This is most commonly done through a unit of measurement known as a carbon credit.

Technically, there are two distinct types of carbon credit.

The first is part of a government-established cap-and-trade program. Under this initiative, the government will release a certain number of carbon credits each year. The hard cap on available credits is lowered annually, making them progressively more expensive and further incentivizing emissions reduction.

Typically, each credit represents 1 metric ton of carbon dioxide or equivalent greenhouse gas. Depending on the region, a company may be taxed or otherwise penalized for exceeding its allowance and failing to purchase additional credits.

While government-issued carbon credits can be traded, they may only be purchased by an individual or entity in the associated region.

The second type of carbon credit is often referred to as a carbon offset, where voluntary carbon credits may be bought and sold by anyone.

They functionally represent a new asset class that has already attracted considerable attention from wealthy investors.

Instead of being issued by a government, voluntary carbon credits are associated with an investment in a carbon reduction project. This is typically defined by a project design document, which specifies details such as land title, volume, additionality and measurability.

As mentioned, voluntary carbon credits can be freely purchased and traded. Let’s say, for instance, that a business generates 200 MT of CO2 over a typical year. The company buys 200 MT worth of carbon credits.

If it goes over that number, it will need to purchase enough carbon credits to make up the difference. On the other hand, if its annual emissions are lower than 200 MT, it can sell the excess credits to another entity.

The carbon market is governed and managed by multiple independent standards agencies. Operating similarly to the International Accounting Standards Body, each of these agencies has its own carbon credit verification process. Verra and The Gold Standard are by far the two largest carbon offset regulators, though there are also multiple regional and national bodies.

In broad strokes, these regulators all serve the same function. They assess all relevant data about a carbon reduction project to determine whether or not it meets their standards. This helps to ensure investors get their money’s worth when purchasing voluntary carbon credits.

Once a standards body has verified that a project reduces carbon and has the potential for further reduction or restoration, it then issues carbon credits for that project. Those credits may be either purchased directly or deployed under revenue-sharing streaming or royalty agreements.

Nature-based carbon projects

Nature-based carbon projects are exactly what they sound like – carbon reduction projects focused on the conservation, restoration and management of natural ecosystems. It’s a critical component of addressing the climate crisis, considering that deforestation is attributed to 30 percent of all carbon emissions.

Instead of investing heavily in new technology, nature-based projects focus on repairing and preventing damage to the planet and, at the same time, provide significant social benefits to the local communities where they operate. These projects often actively promote carbon removal as restored plants, sediments and soils capture, and sequestration of carbon dioxide from the air. In some cases, a nature-based carbon project can also help prevent emissions.

Nature-based solutions also come with a multitude of other benefits, including healthier ecosystems; reduced likelihood of flooding; reduced soil erosion; and prevention of extreme weather phenomena; and social and economic livelihood for the community.

While they do have considerable potential, the impact of these projects only extends so far. According to Bronson Griscom and colleagues at The Nature Conservancy, cost-effective nature-based carbon projects could contribute up to 20 percent of the mitigation needed to address climate change. The remaining 80 percent must come from active emissions reduction efforts.

It’s also worth noting that nature-based carbon projects have yet to reach their full potential. G20 countries currently invest roughly $120 billion annually into nature-based solutions. According to a joint analysis by the UN Environment Programme, the World Economic Forum and the Economics of Land Degradation Initiative, this number needs to increase to at least $285 billion by 2050.

A booming market

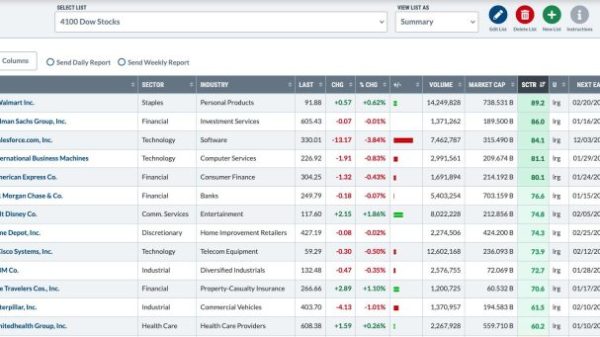

Government investment is far from the only option for new nature-based carbon reduction initiatives. The voluntary carbon market is thriving, with demand expected to reach 15 gigatons by 2030. This demand has led to the rise of multiple entities, each representing a promising investment in its own right.

Klimat X (TSXV:KLX), an industrial-scale carbon exploration and development company operating across multiple jurisdictions, is developing a globally diversified blue carbon and forestry portfolio. Founded by Dr. James Tansey and supported by senior executives from the carbon and resources sector, Klimat X owns between 40 and 100 percent of three initial assets and maintains a development pipeline with more than 3 million metric tons of carbon credits diversified across Asia, Africa and Latin America. It focuses on developing larger-scale jurisdictional agreements to invest more capital into large-scale carbon exploration and development.

In Sierra Leone, for example, the company has just completed its second year of planting covering 1,400 hectares, which is part of a carbon credit pre-purchase agreement with a Fortune 100 company signed in April 2023.

Formed from a merger between Bluesource and Element Markets, Anew Climate has transacted more than 150 million metric tons of carbon and developed over 400 carbon reduction projects. In addition to operating as a project developer, Anew also serves as a broker, advisor and trader.

Lastly, though not quite as large as Anew, BP (NYSE:BP) subsidiary Finite Carbon claims to be North America’s largest forest carbon offset developer by volume. It has, to date, worked on more than 60 forest projects across almost 4 million acres. It has transacted and issued 98 million offsets valued at more than $900 million.

Investor takeaway

The global climate crisis is nearing a tipping point. Now more than ever, we need carbon reduction projects to help curb emissions. Carbon markets not only allow those projects to develop and thrive but also represent a promising investment target for anyone looking to make their portfolio greener and more sustainable.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Klimat X and seek advice from a qualified investment advisor.