The US Federal Reserve announced on Wednesday (July 31) that it will continue to hold its benchmark interest rate steady at 5.25 to 5.5 percent following the two-day Federal Open Market Committee (FOMC) meeting.

The central bank has now maintained its policy for one year following its last rate increase in July 2023.

The meeting comes just days after the Bureau of Labor statistics released the personal consumption expenditures (PCE) index, which showed inflation continued to cool in June. The data showed a year-over-year increase of 2.5 percent in June, down from the 2.6 percent reported in May.

The index is a favored measure of the Fed as it continues to work to bring inflation back down to its target rate of 2 percent.

In its decision on Wednesday, the committee said it was seeking greater confidence that inflation is moving sustainably toward its target but would continue to assess “incoming data as it is available, the evolving outlook and the balance of risks.” It reiterated that the economic outlook remained uncertain, and it would continue to monitor economic indicators and labor market conditions.

Analysts widely expected the central bank to leave its rate unchanged in July, with a greater number of economists predicting the first cut to come during its meeting in September.

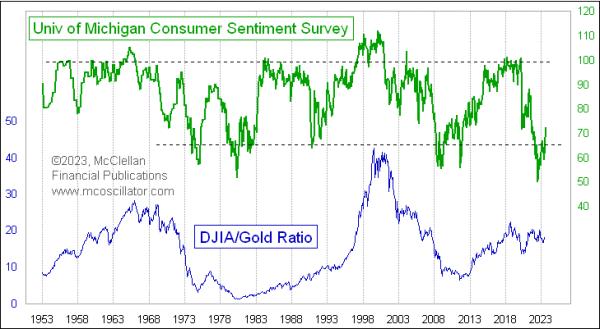

Markets rallied ahead of the release, with the Nasdaq 100 (INDEXNASDAQ:NDX) and S&P 500 (INDEXSP:.INX) leading the way with 3.25 percent and 1.7 percent gains following a strong earnings report from AMD (NASDAQ:AMD) that pushed chipmakers and the tech sector higher. Meanwhile, the Dow Jones Industrial Index (INDEXDJX:.DJI) was up just under 1 percent.

Gold and silver were also up in morning trading fueled by increasing tension in the Middle East following Israeli assassinations of Hezbollah and Hamas leadership in Lebanon and Iran respectively, and they both spiked further following the Fed meeting. As of 3:40 pm EDT, gold had climbed 1.28 percent from the open of markets today to move above US$2,450, and silver had climbed 1.26 percent in the same period to hit US$29.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.