What a week! Mega-cap tech stocks, the Fed meeting, and January’s nonfarm payrolls made headlines this week, creating an exhilarating week for investors. Friday’s stock market price action was an unexpected, but optimistic end to the trading week.

Jobs, Jobs, Jobs

The January jobs report came in way better than expected, and you’d think that would lead to a selloff after Fed Chairman Powell’s comments on Wednesday. Yet investor optimism prevailed, and the broader stock market indices closed higher, with the S&P 500 ($SPX), Dow Jones Industrial Average ($INDU), and Nasdaq 100 ($NDX) closing at an all-time high. It’s beginning to sound like a broken record, almost as if the stock market is waiting for the Nasdaq Composite to catch up and notch a new record high.

The blowout jobs report from the Bureau of Labor Statistics showed that the US economy added 353,000 jobs, well above the 185,000 estimate. The unemployment rate was 3.7%, slightly lower than the expected 3.8%. Wage growth also rose.

Thus, a combination of more jobs and higher wages buries even the slightest probability of a March rate cut. May is still a ways away, and plenty of data will come out before then, but it would be surprising if anything moves the needle enough to warrant a rate cut in March.

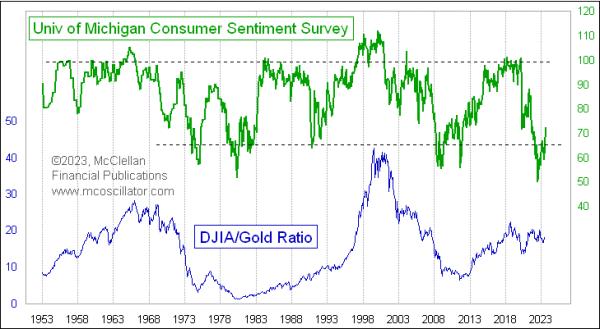

A strong labor market is great for the economy. The question is whether it aligns with what the FOMC wants to see—a rebalancing of the labor market. It’s possible that a rebalance between supply and demand of jobs will occur, given that hours worked per week fell to 34.1. If that continues to fall, and companies start cutting jobs, that would indicate a rebalancing. Another data point to focus on is the number of people working or available for work. If that also declines, it would be further confirmation that the supply and demand forces of the labor market are coming more into equilibrium. But we won’t know that for a while, and investors seem to have shifted their focus to the present.

Tech Stocks Back In Focus

The stock market didn’t seem worried about the stellar jobs report, and Chairman Powell’s comments are now in the rearview mirror. The broader market indices closed higher, with big tech stocks in the spotlight. Earnings from Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), and Meta Platforms (META) were mixed, but that didn’t stop tech stocks from being the stars at the tail end of the trading week. AI is still the buzzword that fuels this market.

Consumer demand is strong, as reflected by Amazon’s earnings on Thursday. And META, which reported strong Q4 earnings and positive Q1 guidance, soared after Thursday’s close. But that wasn’t all; META will be issuing a quarterly dividend of $0.50 per share for the first time. This news boosted the stock price higher, and META closed at $474.99 per share, up 20.32%, hitting an all-time high. That’s a $197 billion addition to its market cap.

CHART 1. META STOCK SOARS ON EARNINGS AND DIVIDENDS. Meta notches an all-time high on strong earnings, guidance, and news of dividends to shareholders.Chart source: StockCharts.com. For educational purposes.

One area of the market that struggles to keep up with the broad indices is small caps. Small-cap stocks tend to perform better in a lower interest rate environment, and since rate cuts aren’t on the Fed’s radar at the moment, the S&P 600 Small Cap Index ($SML) was one of the few reds in the Market Overview panel in the StockCharts dashboard.

Speaking of interest rates, the 10-year US Treasury yield chart paints a good picture (see below). The 10-year yield is back above 4% after sharply falling and hitting a low of 3.817%.

CHART 2. 10-YEAR TREASURY YIELD SPIKES. The strong January jobs report sent the benchmark 10-year US Treasury Yield Index spiking. In spite of the big jump, the yield closed lower for the week.Chart source: StockCharts.com. For educational purposes.

Today’s move in yields didn’t help bond prices. The iShares 20+ Year Treasury Bond ETF (TLT) was down 2.21%.

The Bottom Line

Overall, 2024 has started positively, which is good for stocks. Hearing some of the takeaways from the Fed speeches next week will be interesting. After this week’s performance, maybe the market won’t be impacted by rate cut delays. This stock market just keeps going and going; if delaying rate cuts isn’t going to stop it, what will?

Next week is another week. If you’re considering adding positions to your portfolio, take advantage of any pullbacks while the market trends higher. Only if there’s a drastic turn of events should you think otherwise.

End-of-Week Wrap-Up

S&P 500 closes up 1.07% at 4,958.61, Dow Jones Industrial Average up 0.35% at 38,654.42; Nasdaq Composite up 1.74% at 15,628.95

$VIX down 0.22% at 13.85

Best performing sector for the week: Consumer Discretionary

Worst performing sector for the week: Energy

Top 5 Large Cap SCTR stocks: Super Micro Computer, Inc. (SMCI); Affirm Holdings (AFRM); CrowdStrike Holdings (CRWD); Veritiv Holdings, LLC (VRT); Nutanix Inc. (NTNX)

On the Radar Next Week

Earnings week continues with Walt Disney Co. (DIS), Gilead Sciences (GILD), Alibaba Group Holding (BABA), Eli Lilly (LLY), and Snap Inc. (SNAP) reporting.

January PMI and ISM

Fed speeches

November S&P/Case-Shiller Home Price

Fed Interest Rate Decision

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.