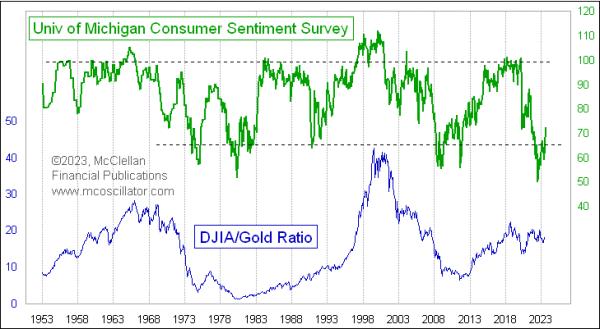

Americans are heading into 2024 more optimistic about the health of the economy than they have been in months.

The Conference Board reported Wednesday that its Consumer Confidence Index, a measure of how Americans feel about business conditions and the United States’ job market, rose to 110.7 in December, up from 101.0 in November. A component gauge of consumers’ expectations for the next six months saw the largest one-month jump since July.

The upticks are especially noteworthy since consumer spending comprises about two-thirds of the nation’s economy — and has remained solid despite months of shoppers voicing unusual levels of gloom.

“This is the pivot, the beginning of the end of the ‘vibecession,’” said Joe Brusuelas, chief economist at RSM US, referring to the concept popularized this year that consumers’ attitudes are out of step with an otherwise strong economy.

This is the pivot, the beginning of the end of the ‘vibecession.’

Joe Brusuelas, chief economist at RSM US

The Conference Board found the optimism was broad-based, rising this month across all age groups and income levels. But the steepest gains were among people ages 35 to 54 and households earning at least $125,000 a year.

Millions of lower-income families are still under intense pressures that top-line survey figures may not fully reflect. High housing costs have driven homelessness to record levels, and grocery prices are exacerbating food insecurity that federal relief programs and food pantries across the country are struggling to address.

Still, the surprise overall surge in consumer confidence comes during a holiday shopping period that has also defied expectations. Retail sales rose 0.3% in November, even though Wall Street economists had forecast a pullback in spending despite robust seasonal discounts.

Consumers have been helped by relief at the pump, where the average cost of a gallon of regular is $3.10, down from $3.31 a month ago (“Gas prices sleighing it,” AAA declared last week). In addition, the job market has cooled steadily but remained strong, with employers trimming hiring while largely avoiding mass layoffs. The unemployment rate has hovered between 3.4% and 3.7% all year — right in range of its historic lows before the pandemic.

Looking ahead to 2024, consumers in the Conference Board survey said they were moderately more interested in buying vehicles, homes and big-ticket appliances.

“The consumer is feeling pretty well as rates move lower, employers add to their payroll, and income expectations improve,” Jeffrey Roach, chief economist at LPL Financial, said in a note Wednesday.

Inflation, now at an annual rate of 3.1%, has slowed sharply over the course of the year, but the Conference Board survey found price increases remain the top concern for consumers. Compared to the 6.3% rate at the beginning of 2023, though, the worst of post-pandemic inflation appears to be in the rearview mirror.

Another boost could be coming from the Federal Reserve, which has signaled that it might start cutting interest rates next year after hiking them to 22-year highs. Although the central bank says its decision-making on rates depends on how inflation develops, cuts could alleviate credit card and auto loan rates that have squeezed consumers. Mortgage rates, reflecting longer-term interest rates, have already started to decline.

The stronger consumer confidence is the latest sign of an economy apparently riding into 2024 clear of a recession, commonly defined as two back-to-back quarters of negative change in gross domestic product. And while plenty of headwinds remain, GDP forecasts have been rising, too, with the Atlanta Fed recently revising up its projection for the economy to grow at an annualized pace of 2.7% in the fourth quarter this year.

It’s a stark contrast to the chorus of warnings in late 2022 that the Fed’s rapid rate hikes would drive up unemployment, snuff out demand across the economy or both.

“Not only did that not happen,” Fed Chairman Jerome Powell said on Dec. 13, but “we actually had a very strong year.”